Filed by the Registrant

Filed by the Registrant

Filed by a Party other than the Registrant

Filed by a Party other than the RegistrantUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant Filed by the Registrant |   Filed by a Party other than the Registrant Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material under §240.14a-12 |

EQUIFAX INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | |

| No fee required. |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) Title of each class of securities to which transaction applies: | |

| (2) Aggregate number of securities to which transaction applies: | |

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) Proposed maximum aggregate value of transaction: | |

| (5) Total fee paid: | |

| Fee paid previously with preliminary materials. |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) Amount Previously Paid: | |

| (2) Form, Schedule or Registration Statement No.: | |

| (3) Filing Party: | |

| (4) Date Filed: | |

1550 Peachtree Street, N.W.

Atlanta, Georgia 30309

www.equifax.com

Dear Shareholders:First and foremost, I want to thank you for your continued investment in Equifax. The past year has been one of the most important in our company’s history. Your Board of Directors and management team have been intensely focused on implementing meaningful changes to our data security systems, technology platforms and risk management processes, in an effort to strengthen our culture, underpin our business strategy and rebuild our relationships with consumers, customers, shareholders and other stakeholders.

Together withAs part of this transformational journey, we made important changes to our leadership team. We appointed Mark Begor as Chief Executive Officer to lead our company on the Equifax management team, we are focused on enhancing financial value, driving operationalpath back to growth and advancingmarket leadership. Mark has established a “tone at the intereststop” for the organization, which prioritizes data security and risk management while maintaining a vital focus on consumers and our customers. We also hired experienced leaders to fill key roles, including our Chief Information Security Officer, Chief Technology Officer, President of U.S. Information Solutions and Senior Vice President of Enterprise Risk and Compliance.

At the Board level, we remain committed to robust governance and responsible oversight. Following our 2018 Annual Meeting, we evaluated the voting results and took a number of actions designed to further enhance the effectiveness of our shareholders. We are pleasedoversight. Among other things, we refreshed the composition of our Audit and Technology Committees, increased the Board’s exposure to, update you on the significant financial, operational and governance actionsparticipation in, security training and shareholder outreach efforts undertaken over the last year.crisis management planning, and oversaw an annual third party assessment of our security program. Most recently, we appointed Heather Wilson, Chief Data Scientist of L Brands, Inc., to our Board and Technology Committee. Heather brings expertise in data, analytics and risk management; these core competencies closely align with our business strategy and its associated risks.

Financial Highlights

UnderIn my role as Independent Chairman, I have continued to engage directly with our shareholders in an effort to be transparent about our continued progress and actions taken following the leadership of our CEO, Rick Smith, Equifax has achieved outstanding growth and performance since September 2005, including total shareholder returns 103% greater than the S&P 500 Index shareholder return and market capitalization growth from $4.3 billion to $15.7 billion. We produced record results in 2016, enabling us to make significant investments to secure future growth while delivering outstanding shareholder returns.2017 cybersecurity incident. During the past year, we completed the largest acquisition inconducted one-on-one engagement with holders of approximately 57% of our history, developed and delivered powerful new analytical insights and expanded our global presence. We also returned significant capital to our shareholders through a total of $157.6 million in dividends. Together, our Board, executive management and all other Equifax team members are building a company that is positioned for future growth and continued profitability.outstanding shares.

Shareholder Engagement and Corporate Governance

Pursuant to our Board-directed shareholder engagement program, we are engaged in thoughtful and constructive dialogue with a significant portion of our shareholder base. InteractionsOur interactions with investors have provided us with valuable feedback on our Board composition, risk management, human capital management, corporate governance and executive compensation, practices over the past year. During the past year, senior management connected with approximately 60% ofamong other topics. We value our shareholder base, including the majority ofshareholders and will continue to evaluate and integrate investor feedback into our top 50 shareholders. Below are just a fewBoard discussions and business decisions.

On behalf of the areas we focusedBoard, I invite you to attend our 2019 Annual Meeting of Shareholders, which will be held on as partMay 2, 2019 at 9:30 a.m., Central Time, at our Equifax Workforce Solutions headquarters located at 11432 Lackland Road, St. Louis, Missouri, 63146. A notice of our commitment to our Companythe meeting and our shareholders.2019 Proxy Statement containing important information about the matters to be voted upon and instructions on how to vote your shares follow this letter.

Your vote is very important to us. Please vote now even if you plan to attend the Annual Meeting in person. Thank you for your continued support of Equifax. Sincerely, Mark L. Feidler Independent Chairman of the Board of Directors March 22, 2019

| |||

1550 Peachtree Street, N.W.

Atlanta, Georgia 30309

Notice of 20172019 Annual Meeting of Shareholders

WHEN:

May 2, 2019

9:30 a.m., Central Time

WHERE:

Equifax Workforce Solutions

11432 Lackland Road

St. Louis, Missouri 63146

RECORD DATE:

March 1, 2019

| AGENDA: | ||

| 1. | Elect the |

| 2. | Hold a non-binding, advisory vote on the compensation paid to the Company’s named executive officers (commonly referred to as a “say-on-pay” proposal). | |

| 3. | ||

| Ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for | ||

Proxies in the form furnished are being solicited by the Board of Directors of Equifax Inc. for this meeting.

YOUR VOTE IS VERY IMPORTANTIMPORTANT.. PLEASE SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS AS SOON AS POSSIBLE, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING.Most shareholders have a choice of voting over the Internet, by telephone or by using a traditional proxy card. Please refer to the enclosed proxy materials or the information forwarded by your bank, broker or other holder of record to see which voting methods are available to you.

This year we will again seek to conserve natural resources and reduce costs by electronically disseminating annual meeting materials, as permitted by the Securities and Exchange Commission (“SEC”). Unless otherwise requested, shareholders will receive a Notice of Internet Availability of Proxy Materials with instructions for accessing these materials via the Internet. You can also receive, upon request, a copy of the proxy materials by mail if you prefer. All shareholders who have previously requested paper copies of our proxy materials will continue to receive a paper copy of the proxy materials by mail. Proxy materials or a Notice of Internet Availability were first sentmade available to shareholders beginning on March 24, 2017.22, 2019.

By order of the Board of Directors,

John J. Kelley IIILisa M. Stockard

| March |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held on May 2, 2019. The Notice, Proxy Statement and Annual Report to are available atwww.proxyvote.com.

| REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS: | |||

| VIA THE INTERNET

|   | BY MAIL

|

| |||

| BY TELEPHONE |  | IN PERSON |

| Call the telephone number on your proxy card |  |

Attend the Annual Meeting and vote in person | |

ELECTION TO RECEIVE ELECTRONIC DELIVERY OF FUTURE ANNUAL MEETING MATERIALS. You can expedite delivery and avoid costly mailings by confirming in advance your preference for electronic delivery. For further information on how to take advantage of this cost-saving service, please see page |

EQUIFAX INC. - 20172019 Proxy Statement53

This summary highlights certain information contained elsewhere in ourthis Proxy Statement. TheThis summary does not contain all of the information that you should consider, and we encourage you to read the entire Proxy Statement before voting.

2016 Performance HighlightsEquifax 2019 Annual Meeting Information

Exceptional Long-Term Performance

Since Rick Smith joined the Company in September 2005 as our Chairman and CEO, he has driven exceptional financial performance and created significant shareholder value. Market capitalization of $15.7 billion at the end of February 2017 was 3.7 times the Company’s $4.3 billion market capitalization at the end of September 2005, and total shareholder return for the Company over this period was 294%, compared to 145% for the S&P 500 Index. A $100 investment made on September 30, 2005 in Equifax stock would be worth approximately $375 as of February 28, 2017, whereas the same investment in the S&P 500 Index would be worth approximately $192. The leadership and vision Mr. Smith has brought to the Company is particularly evident in our growth over the last five years:

| Items for Vote | Board Voting Recommendation | ||

| 1 | Election of 10 directors | ||

| 2 | Advisory vote to approve named executive officer compensation (Say on Pay) | FOR | |

| 3 | Ratification of appointment of Ernst & Young LLP as independent registered public accounting firm for 2019 | FOR | |

In addition, shareholders may be asked to consider any other business properly brought before the meeting or any adjournment or postponement thereof.

Voting and Admission Information

Voting. Holders of our common stock as of the record date, March 1, 2019, are entitled to notice of and to vote at our 2019 Annual Meeting. Each share of common stock outstanding on the record date is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on at our 2019 Annual Meeting. Even if you plan to attend our 2019 Annual Meeting in person, please cast your vote as soon as possible.

| REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS: | ||||

| VIA THE INTERNET Visit the website listed on your proxy card |  | Sign, date and return your proxy card in the enclosed envelope | |

|  | |||

Call the telephone number on your proxy card |  | IN PERSON Attend the Annual | ||

Admission. Equifax shareholders as of the record date are entitled to attend the 2019 Annual Meeting. To attend, shareholders must present proof of stock ownership and a valid photo ID. Please review the admission procedures in this Proxy Statement under“Questions and Answers about the Annual Meeting.”

EQUIFAX INC. -2019 Proxy Statement4

Our Company

Overview

Equifax Inc. is a global data, analytics and technology company. We use unique data, innovative analytics, technology and industry expertise to power organizations and individuals around the world by transforming knowledge into insights that help make more informed business and personal decisions. We operate or have investments in 24 countries in North America, Central and South America, Europe and the Asia Pacific region, and employ approximately 11,000 employees worldwide.

We understand that credit reporting agencies like Equifax have an important responsibility to protect the personal data we hold, to provide accurate information to financial institutions making important risk decisions and to facilitate greater access to credit for consumers. We recognize the disruption and impact that the 2017 cybersecurity incident caused for consumers and our customers and feel a strong duty to ensure that the financial ecosystem is functioning in a way that benefits consumers, safeguards their personal data and is fueled by accurate and complete information.

EFX2020 Strategy

Since his appointment in April 2018, our Chief Executive Officer, Mark Begor, has been leading Equifax through a significant transformation, including the investment of substantial resources to achieve our vision of becoming a trusted global leader in data, advanced analytics and technology. In February 2019, we outlined the key strategic initiatives that comprise EFX2020, our multi-year business transformation strategy. This strategy is designed to help focus our efforts on the following imperatives:

Our business strategy is described in more detail in our 2018 Annual Report on Form 10-K filed with the SEC on February 21, 2019.

EQUIFAX INC. - 20172019 Proxy Statement5

Update on Key Business Initiatives

We operate in many markets around the globe but are committed to operating as “One Equifax,” a single organization with the same goals and values across all of our locations. Under the leadership of our CEO and with oversight by our Board, we are focused on a culture ofsecurity, technology, risk managementandinvestment in our employees. In addition, we are making meaningful changes to become a moreconsumer-friendlycredit bureau. Through this commitment to culture, we are able to drive business growth, create solutions for our customers and continuously improve the lives of consumers. Our key achievements in each of these areas are described below.

| FOCUS ON SECURITY • Data is at the core of our business and our highest priority is protecting and safeguarding the information with which we have been entrusted • In 2018, we launched a multi-year initiative to transform our security processes, technology and infrastructure: – Appointed seasoned security expert Jamil Farshchi as our new Chief Information Security Officer, reporting directly to the CEO – Established a “security-first” culture, including in-depth training for our employees and our Board – Added a significant number of new team members to our security organization – Added a cybersecurity performance measure under our annual bonus plan – Developed a cyber audit framework for the Board to more effectively assess and address cybersecurity issues – Evaluated the maturity of our security program, as determined by a third party assessor that measured our progress toward goals we established by reference to the NIST security framework, a voluntary framework consisting of standards, guidelines and best practices to manage security-related risk – Achieved our 2018 goals for security program improvements, which directly correspond to the new cybersecurity performance measure added to the 2018 annual bonus plan |

| FOCUS ON TECHNOLOGY • In 2018, we began a multi-year technology transformation plan that represents the largest investment program in Equifax history, with the complete focus of the entire leadership team on rebuilding our technology infrastructure, accelerating our migration to a public cloud environment, employing virtual private cloud deployment techniques, and rationalizing and rebuilding our application portfolio using cloud-focused services: – Appointed experienced leader Bryson Koehler as our new Chief Technology Officer, reporting directly to the CEO – Refreshed over half of the technology leadership team to include top talent from market-leading technology organizations – Hired approximately 1,000 new technology department employees, many of whom have experience with cloud technology – Initiated a cloud and data migration of our data and systems, bringing us closer to our goal of leading our industry in data and technology security capabilities • In February 2019, we appointed Heather Wilson, Chief Data Scientist of L Brands, Inc., as a new independent director and a member of the Technology Committee; she brings deep knowledge of data science and its impact on business transformation across several industries that will benefit our Board, our Company and our customers |

EQUIFAX INC. - 2019 Proxy Statement 6

Total Shareholder Returnat Feb. 28, 2017(indexed at 100 as of Sept. 30, 2005)

Investment and Innovation For Long-Term, Sustainable Growth

2016 was a remarkable year for our Company and our shareholders. We exceeded expectations and delivered strong, profitable growth and shareholder returns across the vast majority of our geographies. Our business units and corporate centers of excellence contributed to these outstanding results by consistently executing on strategic initiatives and leveraging our position on a global scale. Among other achievements, we acquired and integrated Veda Group Limited—the largest acquisition in company history—positioning us for growth in the Asia Pacific geography and further broadening our global presence in important growth markets. We also executed on our strategy to invest in our talent base, growing our Company by 16.5% to approximately 9,500 employees worldwide.

The Company is well positioned for a strong 2017 and beyond. We remain dedicated to the five strategic imperatives that have underpinned our success over the past decade and allowed us to globalize fundamental management disciplines and facilitate greater linkage between our strategy and execution. This operational scale will increase our capacity to continue investing in initiatives to drive innovation and growth. With a compelling vision, dedication to operational excellence and strong commitment to our shareholders, we are uniquely positioned to create unparalleled analytical insights, which will drive our delivery of long-term, sustainable growth.

Shareholder Engagement Actions

Continued delivery of sustainable, long-term value to our shareholders requires regular engagement with our investors. In 2016, we conducted investor outreach meetings with shareholders representing approximately 60% of our shares, during which we discussed corporate governance, executive compensation and other issues. Our investors’ comments are reviewed and considered by our Governance and Compensation Committees, as well as the full Board.

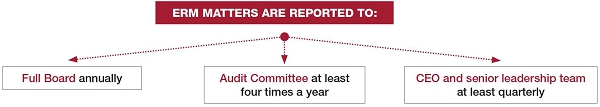

| ENHANCED RISK MANAGEMENT PROCESSES • Our Board and CEO have reinforced our “tone at the top” and focus on risk management, and have been instrumental in making meaningful progress in rebuilding trust and credibility with consumers and our customers – The addition of a cybersecurity performance measure under our annual bonus plan reinforces these cultural changes by further aligning our executives’ incentives with progress against our security program goals • In an effort to strengthen our enterprise risk management program, we have implemented a new Enterprise Risk Management (“ERM”) framework, based on the “three lines of defense” model for establishing effective checks and balances • Established a new Risk Office, with a direct line of communication to the Board, to enhance and coordinate the second line of defense under our updated ERM framework – Appointed a new SVP for Enterprise Risk and Compliance, Kent Lindner, who leads the Risk Office and meets regularly with the Board, the Audit Committee and the Technology Committee – Created an ERM team within the Risk Office to develop, enhance, deploy and manage risk program elements • Key elements of our ERM program include: – Enhancements to our enterprise risk framework, including components and coordination – Risk data aggregation and reporting, creating unified risk and issue capture, analysis and reporting – Promoting a risk culture, including coordinated training, communication and evaluation plans • The technology and security transformation activities described above will continue to be fundamental to our enhanced risk management by ensuring disciplined and coordinated coverage of technology and security risks |

| IMPROVEMENTS FOR CONSUMERS AND IMPACT ON OUR COMMUNITY • Since 2017, we have invested substantial resources on services to assist consumers and improve the consumer experience:

– Launched our Lock & Alert™ service that allows U.S. consumers to quickly lock and unlock their Equifax credit file, online or through an app—for free, for life • We have made, and continue to make, improvements in our – Expanded call center hours, improved phone systems, reduced time to answer calls and improved the – Committed to invest over $50 million in our consumer-facing portals and • We have made investments to support efforts to facilitate financial well-being and – | |

– | ||

– | ||

EQUIFAX INC. - 20172019 Proxy Statement7

| ONE EQUIFAX TEAM – FOCUS ON HUMAN CAPITAL MANAGEMENT AND CORPORATE CULTURE • As a global company, we operate in many markets around the world but are committed to operating as “One Equifax,” a single organization with the same goals and values across all of our locations: – We foster a strong, engaged workplace that is centered around excellence in teamwork, technology, security, risk management and integrity – Members of our Board interact with employees at different levels of management, both formally and informally, to better understand company culture and the employee operating environment – Our CEO regularly engages with employees around the world through in-person town hall meetings, weekly email remarks and key stakeholder meetings – We continue to enhance our robust training program for all employees, especially in the areas of security and compliance – We also demonstrate the value of our employees through recognition programs, referral programs for new hires, employee satisfaction surveys, professional development programs and numerous other initiatives • At Equifax, we attract top talent by providing opportunities to grow and lead within our company and regularly undertake talent initiatives to engage, develop and retain our top talent – In 2018, we added more than 1,000 full-time technology and security professionals to our workforce to help us develop an industry-leading security organization • Diversity and inclusion are important elements of our culture and workforce development and, in 2018, we continued to invest in our global women’s development initiatives |

EQUIFAX INC. - 2019 Proxy Statement8

Board Leadership and Composition Board Leadership Structure • In September 2017, we separated the roles of Chairman and CEO, and appointed independent director Mark Feidler to serve as Independent Chairman of the Board • In April 2018, we appointed Mark Begor as our CEO and a member of the Board • Our Independent Chairman works closely with our CEO and has a broad set of responsibilities including: – Calling meetings of the Board and setting meeting agendas in coordination with the CEO – Presiding at all meetings of the Board and advising the CEO on decisions reached, and suggestions made, at executive sessions of the Board – Facilitating communication among the outside directors, the CEO and other members of management – Meeting directly with management and other employees of the Company – Being available for consultation and direct communication with shareholders Board Composition and Refreshment • In February 2019, the Board elected Heather Wilson, the Chief Data Scientist of L Brands, Inc., as a new independent director and a member of the Technology Committee – Ms. Wilson’s deep knowledge of data science and its impact on business transformation will be of tremendous value to our Company, our Board and our customers as we execute our multi-year technology transformation and implement our business imperatives • Since October 2017, we have added three independent directors with relevant expertise to enhance the overall mix of skills and experience on our Board • Our Committees have also undergone significant refreshment: – The Technology Committee is comprised of three of our newest directors, each of whom brings relevant experience: Scott McGregor, Robert Selander and Heather Wilson. They serve alongside John McKinley, who brings important institutional knowledge and strong leadership to the Committee to enable it to effectively carry out its oversight duties – In addition, Tom Hough began serving as our Audit Committee chair in May 2018. His past experience as Vice Chair of Ernst & Young has proved invaluable as the Company navigates complex financial and accounting issues – In November 2018, Mark Templeton, former member of our Audit and Technology Committees, retired from the Board • The Board will continue to seek out highly-qualified director candidates as part of the Board succession plan to enhance the experience and diversity of our Board to align with our overall strategy Shareholder Engagement • Following our 2018 Annual Meeting, our Independent Chairman Mark Feidler and members of management conducted investor outreach meetings with shareholders representing approximately 57% of our shares • Independent Chairman Mark Feidler participated in one-on-one investor meetings, during which we discussed a number of business and governance-related topics, including Board refreshment and skill sets, company culture and cultural changes, risk oversight, human capital management, executive compensation and corporate governance • The feedback from our investors and other stakeholders was shared with, and reviewed by, our Governance and Compensation Committees, as well as the full Board | Independent, Diverse Independent Chairmanof the Board 30% of our directors arewomen 3 new Independent Directorssince October 2017 Significantrefreshment of Audit and Technology Committees 57% CONDUCTED INVESTOR |

EQUIFAX INC. - 2019 Proxy Statement 9

Enhancements to Board Risk Oversight

Following the 2017 cybersecurity incident, our Board of Directors and management team have taken extensive steps designed to prevent this type of incident from happening again and to earn back the trust of consumers, customers, shareholders and other stakeholders. Key structural developments at the Board level include:

Full Board • The Board enhanced its engagement on data security and crisis management planning, with heightened Board attention to cybersecurity risks and trends, approach to managing these risks, and incorporating cybersecurity as a strategic component of the Company’s business: – Increased Board-level engagement with respect to data security education, including annual cybersecurity training for directors – Added cybersecurity to the list of skills that the Governance Committee should consider in its assessment of Board membership criteria – Cybersecurity is now a regular part of the agenda for the Board’s annual strategy review – Enhanced risk escalation processes to support rapid escalation and internal notification of cybersecurity incidents and to ensure that those with decision-making authority on trading restrictions and pre-clearance requests have notice of any potential security incident – Full Board participates in annual tabletop crisis simulation exercises with the senior leadership team • In an effort to strengthen our ERM program, we have implemented a new risk framework based on the “three lines of defense” model for establishing effective checks and balances, which is used by leading financial institutions. See “How We Manage Risk” and “Board Oversight of Risk” on pages 25-26 – Established a new Risk Office with a direct line of communication to the Board, led by our new SVP for Enterprise Risk and Compliance • The Board is overseeing a transformation of Equifax’s technology infrastructure described under “Focus on Technology” on page 6 |

Technology Committee • The Technology Committee’s expanded responsibilities include: – Oversight of cybersecurity and technology-related risks and management efforts to monitor and mitigate those risks – Oversight of data security in a manner more similar to the Audit Committee’s oversight of financial risks • Pursuant to its charter, the Technology Committee oversees an annual third party assessment of the Company’s security program • The Technology Committee receives regular reports directly from the CISO, the CTO and the internal audit department in connection with quarterly joint meetings of the Audit and Technology Committees • The CISO and CTO meet with the Technology Committee in executive session on a quarterly basis • All members are required to be independent directors | Audit Committee • The Audit Committee and Technology Committee coordinate on risk management oversight with respect to cybersecurity, including through quarterly joint committee meetings • The Audit Committee receives regular reports directly from the CISO, the CTO and the internal audit department in connection with quarterly joint meetings of the Audit and Technology Committees • The Company’s outside auditor attends all joint meetings of the Audit and Technology Committees | |||

Governance Committee • The Governance Committee has responsibility for continued monitoring of the Company’s implementation of recommendations relating to data security oversight developed by the Special Committee formed after the 2017 cybersecurity incident | ||||

EQUIFAX INC. - 2019 Proxy Statement 10

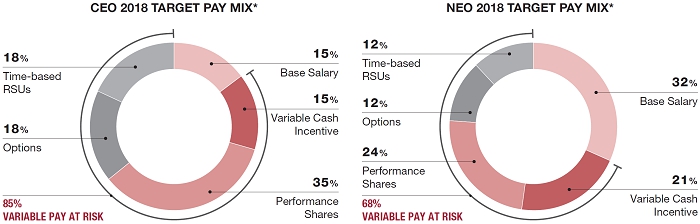

Compensation Program Highlights and Key Changes for 2018 and 2019

Executive Compensation Philosophy

| • | The Compensation Committee of the Board of Directors is primarily responsible for the Company’s executive compensation policies and plans. | |

| • | The Committee works to ensure that pay incentives are performance-based and aligned with shareholders’ interests, while guarding against metrics or goals that create inappropriate or excessive risk likely to have an adverse effect on the Company. | |

| • | The Committee has designed and continuously reviews our compensation program to ensure we are providing competitive pay to attract and retain executive talent. |

Compensation Program Changes

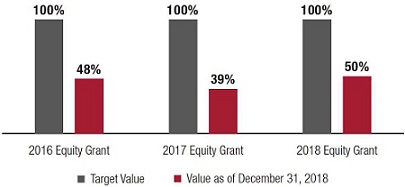

In late 2017 and early 2018, the Compensation Committee undertook a comprehensive review of our short- and long-term incentive compensation program and considered shareholder feedback when it made changes to the 2018 program. In February 2019, in connection with our recently-announced business transformation strategy, the Committee made changes to our long-term incentive program. The changes for 2018 and 2019 are outlined below:

| What We Changed | Details |

| Added Cybersecurity Metric to Annual Bonus Plan | • Beginning with the 2018 annual incentive plan, the Committee added a cybersecurity performance measure as one of the metrics to evaluate performance of all employees, including our executives. This cybersecurity metric is the same measure used to assess the overall strength of our security program, thus ensuring our compensation program reinforces our overall security program goals. The cybersecurity metric remains a component under the 2019 annual incentive plan. |

| Adopted Enhanced Clawback Policy | • In 2018, we revised our compensation clawback policy to add a financial and reputational harm standard. Under the revised policy, the Board may recover incentive compensation awarded to employees in the event of misconduct or failure of oversight that results in significant financial or reputational harm. |

| Adopted Change In Control Severance Plan | • In February 2019, the Committee adopted a new Change in Control Severance Plan (the “CIC Plan”) for senior executives, including our NEOs other than Mr. Begor. The Committee worked with its outside compensation consultant to design a plan with market-standard terms that will provide executives security in the event of a change in control of the Company. The CIC Plan ensures that our executives objectively evaluate potential transactions that may be in the best interest of our shareholders, despite the potential negative consequences such transactions may have on them personally. The CIC Plan will not apply to Mr. Begor, whose change in control protections as contained in his employment agreement were already aligned with the core provisions of the CIC Plan. – Eliminated CIC Letter Agreements.Other than as described above with respect to our CEO, all of our executives with individual change in control agreements (the “CIC Letter Agreements”) agreed to give up their individual agreements and become subject to the new CIC Plan. – Reduced CIC Severance Multiples.Under the CIC Letter Agreements, certain executives were entitled to a severance multiple of 3x. Following the elimination of the CIC Letter Agreements, the severance multiple upon a change in control was set at 2x for all executives other than the CEO, representing a significant decrease in the benefit payable. – Eliminated CIC Tax Gross-Ups.Under the CIC Letter Agreements, certain executives were entitled to tax gross-up benefits in connection with a change in control. Following the elimination of the CIC Letter Agreements, we do not offer tax gross-up benefits in connection with a change in control. |

| Implemented Changes to 2019 Direct Compensation | • No Increase in Base Salary or Annual Bonus Opportunity for NEOs.The Committee determined that our NEOs will not receive any increase to base salary or target bonus opportunity for 2019. The only compensation increases for our NEOs for 2019 relate to our long-term incentive program (described below), which creates greater focus on stock price and multi-year performance and thereby enhances alignment between management and shareholders. • 2019 Equifax Transformation Leadership Program.In connection with our EFX2020 multi-year business transformation strategy (see page 5 for details), the Committee reformulated the long-term incentive program for 2019 to more closely align incentives with our near- and long-term goals. The Equifax Transformation Leadership Program (the “2019 ETLP”) increases the target long-term incentive award opportunity for each NEO and a select group of our senior leadership team members, each of whom is integral to the successful execution of our strategy. In conjunction with the increased opportunity, the degree of overall performance risk has been substantially increased. The Committee expects to revert back to our traditional long-term incentive structure in 2020. The 2019 ETLP is described in detail on pages 49-51. |

EQUIFAX INC. - 2019 Proxy Statement 11

Compensation Best Practices

| Strong emphasis on performance-based compensation, with 85% of CEO pay considered “at-risk” |  Enhanced compensation clawback policy with financial and reputational harm standard, including in supervisory capacity  Double-trigger change-in-control cash severance benefits and vesting of equity awards  Anti-hedging and -pledging policy for officers and directors  Independent Compensation Committee advised by independent compensation consultant  Meaningful share ownership requirements for senior officers  No re-pricing of underwater stock options  No income tax gross-ups other than for relocation or foreign tax expenses | |

| Mix of short-term and long-term incentives and performance metrics | ||

| Added cybersecurity performance measure to 2018 and 2019 annual incentive plans | ||

| Adopted a new change in control severance plan applicable to executive officers, including NEOs who previously had individual change in control agreements. This eliminated income tax gross-ups and reduced payments in connection with a change in control | ||

| All stock options granted under 2019 long-term incentive program are premium-priced | ||

| Capped annual and long-term performance-based awards |

Corporate Governance Highlights

| Independent Board | • | ||

| Board Refreshment | • |

| |

| Since October 2017,

| ||

| • | The Board periodically engages an independent consultant to facilitate its annual Board and | ||

| • | The Governance Committee will continue its ongoing succession planning in candidates | ||

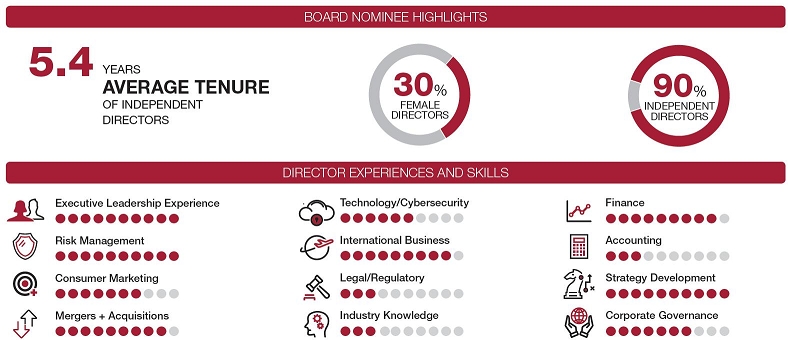

| • | Upon election of the Board’s nominees at the 2019 Annual Meeting, the average | ||

| Separated Chair and CEO Roles, with Independent Chairman | • | In September 2017, we separated the roles of CEO and Chairman, and Mark Feidler was appointed to serve as Independent Chairman of the Board | |

| • | Mr. Feidler will continue to serve as Independent Chairman | ||

|

| ||

| Annual Board LeadershipEvaluation and | • |

| |

| • |

| ||

| Annual Director Election | • | ||

| Limits on Outside BoardService | • |

| |

| Director and Executive Stock Ownership | • |

| |

| Our CEO and |

| ||

|

| ||

| |||

|

|

EQUIFAX INC. - 20172019 Proxy Statement812

What am I voting on and what are the Board’s voting recommendations?

| Rigorous Trading Policyand Protocols |  | We enhanced our risk escalation processes to support rapid escalation and internal notification of potentially significant events, such as a potential data breach, including the impact of such events on our decision of whether to halt trading under the insider trading policy | ||||

| • | Our insider trading policy prohibits our directors, officers and employees from owning financial instruments or participating in investment strategies that hedge the economic risk of owning Equifax stock | |||||

| • | ||||||

| • | ||||||

| • | Our Governance Committee has oversight authority regarding Company political activity (including corporate political expenditures) pursuant to our political engagement policy | |||||

| • | We disclose aggregate annual political contributions made directly by the Company with corporate funds on our website | |||||

| In March 2019, we revised our political engagement policy to specifically address lobbying activities and our Governance Committee’s oversight of | |||||

Proposal 1 — Election of 11EQUIFAX INC. - 2019 Proxy Statement 13

Our Director Nominees

TheOur Board is askingrecommends that you to electvoteFOReach of the 11director nominees for director named below for terms that expire at the 2018 annual meeting. The directors will be elected by a majority vote.2020 Annual Meeting. This year’s Board nominees include twoour new directors—Ms. Elane Stock, retired Group President, Kimberly-Clark International, and Mr. Thomas Hough, retired Americas Vice Chair, Ernst & Young LLP. These additions to our Board reflect our ongoing board refreshment strategy and further strengthen and diversifyindependent director, Heather Wilson, the skills and experiences the Board will rely on to lead the Company toward future growth.Chief Data Scientist of L. Brands, Inc. The following table provides summary information about each nominee, and you can find additional information under “Proposal“Proposal 1,Election of 11 Director NomineesNominees”” on page 12.15.

|  |  |  |  | |||||

| |||||||||

| |||||||||

| |||||||||

MARK W. BEGOR Age: 60 | MARK L. FEIDLER Founding Partner of Age: 62 Committees: Compensation, Governance | G. THOMAS HOUGH Retired Americas Vice Age: 64 Committees: Audit (Chair) |  | ROBERT D. MARCUS Former Chairman and | |||||

| Chief Executive Officer of Time Warner Cable Inc. Age: 53 Director since2013

|  | Compensation (Chair) Governance | |||||||

| |||||||||

SIRI S. | MARSHALL Retired Age: 70 Director since2006 Committees: Compensation, | ||||||||

| |||||||||

|  |  |  |  | |||||

SCOTT A. MCGREGOR Former President and Age: 62 Director since2017 Committees: Audit, Technology | JOHN A. MCKINLEY Chief Executive Officer of SaferAging, Inc. and Co-Founder of |  | Age: 61 Director since2008 Committees: Audit, | ||||||

ROBERT W. SELANDER Former President and Age: 68 Director since2018 Committees: Compensation, Technology | |||||||||

ELANE B. | Former Group President Age: 54 Director since2017 Committees: Audit, Governance |  | |||||||

HEATHER H. WILSON Chief Data Scientist of L Brands, Inc. Age: 47 Director sinceFeb. 2019

|  | Technology |

|

EQUIFAX INC. - 20172019 Proxy Statement9

Board Expertise and Skills

Our Board is comprised of experienced leaders with the right skills and business experience to provide sound judgment, critical viewpoints and guidance in an evolving environment. The following chart represents some of the key skills that our Board has identified as particularly valuable to the effective oversight of the Company and the execution of our strategy. You can find additional information under “Board Skills Matrix” on page 16 that highlights the depth and breadth of skills on the Board.

PROPOSAL 2 — Advisory Vote to Approve Named Executive Officer Compensation

The Board is asking you to approve, on an advisory basis, the compensation of our CEO, CFO and the three other most highly compensated executive officers calculated in accordance with SEC rules and regulations (collectively, the named executive officers or NEOs) as disclosed in this Proxy Statement.

2016 Compensation Program Overview

|

| |||

|

|

Compensation Best Practices

What We Do

|

|

EQUIFAX INC. - 2017 Proxy Statement10

PROPOSAL 3 —Advisory Vote on Frequency of Future Say-on-Pay Votes

The Board recommends ANNUAL frequency for future say-on-pay votes.

The Board is asking you to ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017.

PROPOSAL 5 — Shareholder Proposal Regarding Political Contributions Disclosure

The Board recommends a vote AGAINST this shareholder proposal.

The Company has made an extremely limited number of political contributions in amounts that are not financially material. Aggregate political contributions made directly by the Company with corporate funds totaled approximately $1,500, $2,000 and $10,250 in 2016, 2015 and 2014, respectively. In addition, the Company is transparent and accountable regarding its political contributions. A description of the Company’s oversight of political engagement, including several governance enhancements that the Board has implemented since the last annual meeting, is set forth under “Board’s Statement Opposing Proposal 5” on page 61.

EQUIFAX INC. - 2017 Proxy Statement1114

| PROPOSAL 1 | Election of |

All members of our Board are elected to serve until the next annual meeting of shareholders and until their successors have been elected and qualified. The 1110 nominees for election listed below have consented to being named in this Proxy Statement and to serve if elected. This year’s nominees include twoone new directors, Ms. Elane Stock and Mr. Thomas Hough.independent director, Heather Wilson, Chief Data Scientist of L Brands, Inc. All director nominees attended 75% or more of the aggregate of the meetings of the Board and of the committees of the Board on which such directors served during 2016. In addition, each nominee2018. All of the director nominees then serving attended the 2016 annual meeting of shareholders and was re-elected at such meeting.2018 Annual Meeting.

Our directorsdirector nominees have a variety of backgrounds, which reflects the Board’s continuing objective to achieve a diversity of perspective, experience, knowledge, ethnicity and gender. As more fully discussed under “Director Membership Criteria and Nomination Processes” on page 20,24, director nominees are considered on the basis of a range of criteria, including their business knowledge and background, reputation and global business perspective. They must also have demonstrated experience and ability that is relevant to the Board’s oversight role with respect to Company business and affairs. Presented below is biographical information for each of the nominees.

THE BOARD RECOMMENDS A VOTE “FOR” “FOR”THE ELECTION OF EACH NOMINEE LISTED BELOW.

Our Director Nominees

| MARK W. BEGOR | ||||

| Director since Age Chief Executive |

| ||

Overview of Board Qualifications

| ||||

|

| |||||

| ||||||

EQUIFAX INC. - 20172019 Proxy Statement1215

| MARK L. FEIDLER | ||||

| Director since 2007

| Founding Partner of MSouth Equity Partners, a private equity firm based in Atlanta, since February 2007. Mr. Feidler was President and Chief Operating Officer and a director of BellSouth Corporation, a telecommunications company, from 2005 until January 2007. Mr. Feidler served as its Chief Staff Officer during 2004. From 2001 through 2003, Mr. Feidler was Chief Operating Officer of Cingular Wireless and served on the Board of Directors of Cingular from 2005 until January 2007.

Other Public Directorships

•New York Life Insurance Company (Lead Director) | ||

Overview of Board Qualifications

Mr. Feidler has extensive operating, financial, legal and regulatory experience through his prior position with a major regional telecommunications company, as well as expertise in private equity investments and acquisitions. This background is relevant to us as we market our products to companies in telecommunications and other vertical markets, while his private equity experience is relevant to our new product development, marketing and acquisition strategies. His public company operating experience and background in financial, accounting, technology and risk management are an important resource for our Board. | ||||

| ||||||

| G. THOMAS HOUGH | ||||

| Director since 2016

Audit Committee (Chair) | Retired Americas Vice Chair of Ernst & Young LLP, an international public accounting firm.

Other Public Directorships

•Publix Super Markets, Inc. • Federated Fund Family • Haverty Furniture Companies, Inc. | ||

Overview of Board Qualifications

Mr. Hough brings invaluable experience in audit, accounting, finance and corporate governance. His background in financial accounting and risk management, including leadership experience at a major international accounting firm, is of particular importance to our Board. | ||||

| ROBERT D. MARCUS | ||||||

| Director since

|

| |||||

| |||||||

EQUIFAX INC. - 2017 Proxy Statement13

|

| Other Public Directorships • Ocean Outdoor Limited | ||

Overview of Board Qualifications

Mr. Marcus has extensive operating, financial, legal and regulatory experience through his position | ||||

EQUIFAX INC. - 2019 Proxy Statement 16

| SIRI S. MARSHALL | ||||

| Director since 2006

| Retired Senior Vice President, General Counsel, Secretary and Chief Governance and Compliance Officer of General Mills, Inc., a global diversified foods maker and distributor, where she served in that position from 1994 until her retirement in January 2008. She is on the Board of Directors of Direct Relief and the Yale Law School Center for the Study of Corporate Law, and on the Board of Advisors of Manchester Capital Management, Inc. During the past five years, Ms. Marshall also served as a director of Ameriprise Financial, Inc., a diversified financial services company, Alphatec Holdings, Inc., a provider of spinal fusion technologies, BioHorizons, Inc., a dental implant and biologics company, and as a Distinguished Advisor to the Straus Institute for Dispute Resolution. In February 2011, Ms. Marshall received the Sandra Day O’Connor Board Excellence Award from DirectWomen.

| ||

Overview of Board Qualifications

Ms. Marshall’s over 13 years of executive experience at General Mills provides a valuable perspective on our organizational management, legal, compliance, regulatory and government affairs, consumer products business and corporate governance. The Board particularly values her broad experience with other public company boards, including | ||||

| SCOTT A. MCGREGOR | ||||

| Director since 2017

| Former President, Chief Executive Officer and Director of Broadcom Corporation, a world leader in wireless connectivity, broadband and networking infrastructure. Mr. McGregor served in those positions from 2005 until the company was acquired by Avago in 2016. From 2016 to 2017, Mr. McGregor served on the board of directors of Xactly Corporation. Mr. McGregor served on the board of directors of Ingram Micro, Inc. from 2010 to 2016. From 2001 to 2005, Mr. McGregor served as President and Chief Executive Officer of the Philips Semiconductors division of Royal Philips Electronics. Prior thereto, Mr. McGregor was head of Philips Semiconductors’ Emerging Business unit from 1998. Mr. McGregor served in various senior management positions of Santa Cruz Operations, Inc. from 1990 to 1997. Other Public Directorships • Applied Materials, Inc. | ||

Overview of Board Qualifications Mr. McGregor has extensive executive management, cybersecurity, information technology and risk management experience gained in over ten years as President and Chief Executive Officer of Broadcom and in senior positions at Royal Philips Electronics. This experience is particularly important to us as we continue to focus on strengthening our data security. | ||||

| JOHN A. MCKINLEY | ||||

| Director since 2008

| Chief Executive Officer of SaferAging, Inc., a senior care service provider based in Washington, D.C., and Co-founder of LaunchBox Digital, a venture capital firm in Washington, D.C. Mr. McKinley was Chief Technology Officer of News Corporation from July 2010 to September 2012. He was President, AOL Technologies and Chief Technology Officer from 2003 to 2005 and President, AOL Digital Services from 2004 to 2006. Prior thereto, he served as Executive President, Head of Global Technology and Services and Chief Technology Officer for Merrill Lynch & Co., Inc., from 1998 to 2003; Chief Information and Technology Officer for GE Capital Corporation from 1995 to 1998; and Partner, Financial Services Technology Practice, for Ernst & Young International from 1982 to 1995. | ||

Overview of Board Qualifications

The Board highly values Mr. McKinley’s extensive background in managing complex global technology operations as chief technology officer at a number of leading global companies. These skills are highly relevant to the Board’s oversight of risks and opportunities in our technology operations, including data and cybersecurity, risk management and capital investments. The Board also values his technology and industry experience gained from his twelve years as a partner in Ernst & Young’s financial services technology practice, as well as his entrepreneurial insights. | ||||

EQUIFAX INC. - 20172019 Proxy Statement1417

| ROBERT W. SELANDER | ||||

| Director since 2018 Age 68 Independent Compensation Committee Technology Committee | |||

| Former President and Chief Executive Officer of Other Public Directorships • HealthEquity, Inc. (Independent Chairman) • The Western Union Company | |||

Overview of Board Qualifications

| ||||

| ELANE B. STOCK | ||||

| Director since 2017

Governance Committee |

Other Public Directorships

• YUM! Brands, Inc. • Reckitt Benckiser Group PLC | ||

Overview of Board Qualifications

Ms. Stock brings extensive strategy, diversified operations and multi-national experience in leading global consumer and B2B businesses. Her expertise in branding, marketing, sales, strategic planning and international business development is particularly important as Equifax develops and markets new products and services for consumers and businesses across the world. | ||||

| HEATHER H. WILSON | ||||

| Director since 2019 Age 47 Independent Technology Committee | |||

|

|

| ||

Overview of Board Qualifications

The Board highly values | ||||

EQUIFAX INC. - 20172019 Proxy Statement1518

Board Skills Matrix

The Board skills matrix below represents some of the key skills that our Board has identified as particularly valuable to the effective oversight of the Company and the execution of our strategy. This matrix highlights the depth and breadth of the skills on the Board.of our directors standing for election.

| Experience, Expertise or Attribute | McGregor | McKinley | Selander | Stock | Wilson | ||||||||||||||||||||

Business Operations |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |   | |||||

| CEO Experience |  |  |  |  | |||||||||||||||||||||

|   |  |  |  |  | ||||||||||||||||||||

|  |  | |||||||||||||||||||||||

|  |  | |||||||||||||||||||||||

|   |  |  |  | |||||||||||||||||||||

|  |  |  |  |  |  |  |  |  |  | |||||||||||||||

|  |  |  | ||||||||||||||||||||||

|  |  |  |  |  |   |  |  |  | ||||||||||||||||

|  |  |  |  |  |  |  |  | |||||||||||||||||

|  |  |  |  |  |  |  |  |  | ||||||||||||||||

|  |  |  |  |  |  |  |  |  | ||||||||||||||||

|  |  |  |  |  |  |  | ||||||||||||||||||

|   |  |   |  |  |  |  | ||||||||||||||||||

| Finance/Financial Industry |  |  |  |  |  |  |  |  |  | ||||||||||||||||

| Accounting |  |  |  | ||||||||||||||||||||||

| Risk Management |  |  |  |  |  |  |  |  |  |  | |||||||||||||||

| International Business |  |  |  |  |  |  |  |  |  | ||||||||||||||||

| Strategy Development |  |  |  |  |  |  |  |  |  |  | |||||||||||||||

| Mergers & Acquisitions |  |  |  |  |  |  |  |  |  | ||||||||||||||||

| Consumer Marketing |  |  |  |  |  |  |  | ||||||||||||||||||

| Legal/Regulatory |  |  |  | ||||||||||||||||||||||

| Corporate Governance |  |  |  |  |  |  |  |  |  |  |   |  |  |  |

BOARD LEADERSHIP & CORPORATE GOVERNANCE

Equifax Corporate Governance

Our Board of Directors and management team are committed to achieving and maintaining high standards of corporate governance, ethics and integrity. We conduct our business in a manner that is socially responsible, value-based and in compliance with the law. We periodically review our governance policies and practices against evolving standards and make changes as appropriate. We also value the perspectives of our shareholders and other stakeholders, including our employees and the communities in which we operate, and take steps to implement their points of view when warranted.

Investor engagement over the last several years has prompted review of and changes to our governance practices, and our Board remains committed to continuous improvement. See “Corporate Governance Highlights” on page 8pages 12-13 for a summary of our key governance practices, including a descriptionpractices. In addition, following our 2018 Annual Meeting, we conducted investor outreach meetings with shareholders representing approximately 57% of our new proxy access bylaw provisionshares. Our Independent Chairman, Mark Feidler, participated in one-on-one investor meetings, during which we discussed a number of business and recent enhancementsgovernance-related topics, including Board refreshment and skill sets, company culture and cultural changes, risk oversight, human capital management, executive compensation and corporate governance. Those conversations provided valuable insight that has informed the Board’s decision-making on several of the improvements to our oversight of political engagement activities.corporate governance described in this Proxy Statement.

The following sections summarize our corporate governance policies and practices including our Board leadership structure, our criteria for director selection and the responsibilities and activities of our Board and its committees. Our corporate governance documents, including the Board’s Mission Statement andGovernance Guidelines, on Significant Corporate Governance Issues (the “Governance Guidelines”), our Board committee charters and our codesCode of ethicsEthics and business conductBusiness Conduct applicable to our directors, officers and employees, are available at https://www.equifax.www.equifax.com/com/about-equifax/corporate-governance, or in print upon request to Equifax Inc., Attn: Office of Corporate Secretary, P.O. Box 4081, Atlanta, Georgia 30302, telephone (404) 885-8000. These codes provideThe Code of Ethics and Business Conduct provides our policies and expectations on a number of topics, including our commitment to good citizenship, providing transparency in our public disclosures, prohibiting insider trading, avoiding conflicts of interest, honoring the confidentiality of sensitive information, preservation and use of Company assets, compliance with all laws and operating with integrity in all that we do. There were no waivers from any provisions of our codes or amendments applicable to any Board member or executive officer in 2016.

EQUIFAX INC. - 20172019 Proxy Statement 1619

Board Leadership Structure

The Board annually reviews its leadership structure.structure, and our governance documents provide the Board with the flexibility to select the appropriate leadership structure for us at any given time. In prior years, the roles of Chairman and CEO were combined. However, after the 2017 cybersecurity incident, and simultaneous with the appointment of our interim CEO, the Board determined to adjust its leadership structure to separate the roles of Chairman and CEO. Mark Feidler, who had previously served as a leader for the independent directors in his role as Presiding Director, was elected to the role of Independent Chairman. The Board concluded that this new structure would allow our then-interim CEO to focus his attention on leading the Company’s response to the 2017 cybersecurity incident and efforts to rebuild trust with shareholders, consumers, customers and other stakeholders.

In connection with the appointment of Mr. Begor as our CEO, the Board re-evaluated the leadership structure and determined to retain the current structure of separate Chairman and CEO roles, with Mr. Feidler continuing to serve as our Independent Chairman. This structure provides for direct independent oversight of management and clearly delineates the role of the Board as a source of insight and oversight for management. The Board believes its currentthis leadership structure, and composition, along with the strong leadership of ourwhich also includes a majority independent directors (11 of 12 current members),Board and fully independent Board committees, and Presiding Director, andbest serves the highly effective corporate governance structures and processes in place, strike an appropriate balance between consistent leadership andobjectives of the Board’s independent oversight of the Company’s business and affairs. affairs at this time.

| INDEPENDENT CHAIRMAN OF THE BOARD Mark Feidler |

The leadership structurerole and responsibilities of our Board of Directors includes:Independent Chairman include:

| • | ||

| • | Establishing the agenda for | |

| • | Presiding at all meetings of the Board | |

| • | Advising the |

| • | Facilitating communication between the | |

| • | Meeting directly with management and | |

| • | Calling special meetings of shareholders | |

| • | Presiding at meetings of shareholders | |

| • | Being available for consultation and |

In addition, our directors:Annual Self-Evaluations

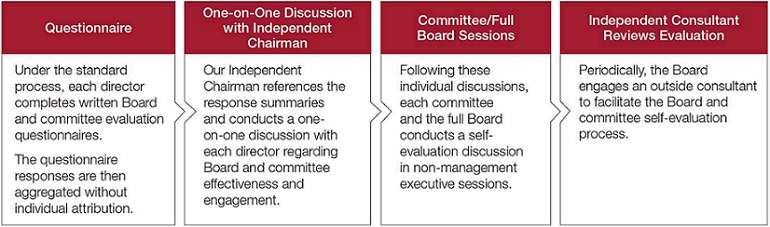

Our Board continually seeks to improve its performance. We have a rigorous annual Board and committee self-evaluation process, which presents the opportunity to examine the Board’s effectiveness and practices and identify areas for improvement. Our Governance Committee annually reviews and recommends the specific format to use for that year’s Board evaluation.

EQUIFAX INC. - 20172019 Proxy Statement 1720

Board Evaluation Process for 2018-2019

The Board periodically engages an independent consultant to facilitate its annual Board and committee self-evaluation process, as it did most recently in connection with the 2017-2018 review cycle. This year, based upon the recommendation of the Governance Committee, the Board determined it was appropriate to implement the standard process for the 2018-2019 evaluation process. Under the standard process, each director completed written Board and committee evaluation questionnaires. The questionnaire responses were then aggregated by the Office of Corporate Secretary without individual attribution and reviewed by the Independent Chairman as well as the committee chairs. The Independent Chairman then participated in one-on-one discussions with each of the other directors, during which they discussed the response summaries. The Independent Chairman reviewed the evaluation results with the full Board of Directors in February 2019. Following review, the Board and its committees identified various opportunities to strengthen the effectiveness of the Board’s practices, structures, competencies and communications. For example, in response to feedback discussed as part of the Governance Committee self-evaluation, the Governance Committee identified an opportunity to enhance the new director orientation process by designating a member of the Board to participate in a one-on-one onboarding session with each new director.

Committees of the Board of Directors

The Board has fivefour standing committees, all of which are comprised of independent directors as defined in the NYSENew York Stock Exchange (“NYSE”) rules. The Board appoints committees to help carry out its duties and work on key issues in greater detail than is generally possible at Board meetings. Committees regularly review the results of their meetings with the Board. In 2016,2018, the full Board held six18 meetings and the standing committees held a total of 34 meetings.

| Committee Memberships | ||||||

| Name and Occupation | Independent | Audit | Compensation | Executive | Governance | Technology |

| James E. Copeland, Jr. |  |  | ||||

| Robert D. Daleo |  |  |  |  | ||

| Walter W. Driver, Jr. |  |  | ||||

| Mark L. Feidler |   |  |  | |||

| G. Thomas Hough |  |  |  | |||

| L. Phillip Humann |  |  |  |  | ||

| Robert D. Marcus |  |  |  | |||

| Siri S. Marshall |  |  |  |  | ||

| John A. McKinley |  |  |  |  | ||

| Richard F. Smith | ||||||

| Elane B. Stock |  |  | ||||

| Mark B. Templeton |  |  |  | |||

| Meetings held in 2016 | 5 | 4 | 0 | 4 | 4 | |

Committee Composition

| Committee Memberships | ||||||||||

| Name | Independent | Audit | Compensation | Governance | Technology | |||||

| Mark W. Begor | ||||||||||

Mark L. Feidler |  |  |  | |||||||

| G. Thomas Hough |  |  | ||||||||

| Robert D. Marcus |  |  |  | |||||||

| Siri S. Marshall |  |  |  | |||||||

| Scott A. McGregor |  |  |  | |||||||

| John A. McKinley |  |  |  | |||||||

| Robert W. Selander |  |  |  | |||||||

| Elane B. Stock |  |  |  | |||||||

| Heather H. Wilson |  |  | ||||||||

| Meetings held in 2018 | 8 | 9 | 9 | 8 | ||||||

EQUIFAX INC. - 2019 Proxy Statement21

| |

| |

|

Committee Responsibilities

Each Committeecommittee operates pursuant to a written charter which is available on the Company’s website atwww.equifax.com/about-equifax/corporate-governance. The following summarizes the oversight responsibilities of each Committee:committee:

| Audit Committee | • | Direct authority to appoint, review and discharge our independent |

| • | Reviews and pre-approves the services provided by our independent auditors and reviews the independence of that | |

| • | Reviews our audited and unaudited financial statements, earnings press releases and financial information and discusses the same with our independent auditors and | |

| • | Reviews the integrity of our financial reporting process and the adequacy and effectiveness of our financial and information technology | |

| • | Oversees our regulatory compliance program and administers our Code of Ethics and Business | |

| • | Reviews our policies related to enterprise risk assessment and risk | |

| • | Oversees our internal audit | |

| • | Meets separately with the internal and external auditors to ensure full and frank communications with the | |

| • | Coordinates with the Technology Committee on risk management with respect to cybersecurity | |

| Compensation Committee | • | Approves and oversees our executive compensation programs and |

| • | Determines executive officer | |

| • | ||

| • | Approves employee compensation and benefit | |

| • | Monitors the effectiveness and funded status of our retirement and 401(k) | |

| • | Advises management and the Board on succession planning and other significant human resources | |

| • | ||

| • | Reviews and approves the creation or revision of any clawback policy | |

| • | Reviews the CD&A and other proxy statement disclosures related to | |

| Governance Committee | • | Reviews and makes recommendations to the Board regarding director nominees and director |

| • | Makes recommendations to the Board with respect to Board and committee organization, membership and | |

| • | Oversees an annual review of the effectiveness of the Board and its | |

| • | Recommends to the Board, and monitors compliance with, our Governance Guidelines and other corporate governance | |

| • | Exercises oversight of director compensation program and makes recommendations on such compensation for approval of the |

EQUIFAX INC. - 2017 Proxy Statement18

| Reviews and discusses with management the Company’s responses to |

| Technology Committee | • | |

| • | Oversees our technology | |

| • | Receives regular reports directly from the CISO, the CTO and the internal audit department, including in executive session without other members of management present | |

| • | Makes recommendations to the Board as to scope, direction, quality, investment levels and execution of technology | |

| • | Oversees engagement of outside advisors to review the | |

| • | Provides guidance on technology as it may pertain to, among other things, investments, mergers, acquisitions and divestitures, research and development investments, |

Director Independence

Our Governance Guidelines provide that a substantial majority of our Board should be independent. Our Guidelines for Determining the Independence of Directors, which may be accessed on our website atwww.equifax.com/about-equifax/corporate-governance, meet or exceed the requirements of SECSecurities and Exchange Commission (“SEC”) rules and regulations and the NYSE listing standards.

The Board has affirmatively determined that all directors, exceptdirector nominees (other than our CEO, Mr. Smith who is an officer of the Company,Begor) are independent under the applicable NYSE listing standards, SEC rules and our Guidelines for Determining the Independence of Directors. In making these determinations, the Board considered the types and amounts of the commercial dealings between the Company and the companies and organizations with which the directors are affiliated. Specifically, in the case of Mr. Hough, the Board considered his former employment with Ernst & Young and the fact that his son is a non-executive employee of the Company. After evaluating these relationships, including discussions with Mr. Hough and Ernst & Young, the Board determined that Mr. Hough’s independence is not impaired. The Board views the independence analysis as an ongoing consideration and will continue to monitor these relationships.

Each director is an equal participant in decisions made by the full Board. All of our Board committeesstanding Committees are comprised solely of independent directors.

EQUIFAX INC. - 2019 Proxy Statement22

Board Refreshment and Succession Planning

The Governance Committee regularly assesses the requirements of the Board and makes recommendations regarding its size, composition and structure. The Governance Committee is focused on how the experience and skill set of each individual director complements those of fellow directors to create a balanced Board with diverse viewpoints, skill sets,skills and expertise and reflecting a diversity of experiences, gender, ethnicity and age. As part of its ongoing strategic review regarding Board refreshment, the Governance Committee seeks to anticipate future needs for expertise in new and emerging markets, security, technology security and regulatory compliance, while also enhancing the diversity on our Board. Among other things, the Governance Committee considers committee composition and chair rotation as part of its overall succession planning process.

Since the 2017 cybersecurity incident, the Governance Committee and the Board have actively sought new directors that can provide valuable guidance as the Company continues to focus on strengthening the Company’s core technology and security competencies and executing on our EFX2020 multi-year business transformation strategy. The Board believes that the additions of Scott McGregor in October 2017, Robert Selander in March 2018 and Heather Wilson in February 2019 provide our Board with additional broad-based executive management experience, as well as enhanced expertise in security, technology, risk management, data and analytics.

Board Tenure and Refreshment.Refreshment

Pursuant to our Bylaws and Governance Guidelines, we have a mandatory retirement age of 72 (65 for employee-directors) after which a director will not be elected or re-elected unless he or she continues in a position or in business or professional activities or possesses special qualifications that the Governance Committee and Board determine would be of substantial benefit to the Company. The following table shows the tenure of our non-management directors, which is well distributed to create a balanced Board. Mr. Copeland will reach the mandatory retirement age of 72 prior to our Annual Meeting and thus not stand for re-election, and Messrs. Driver and Humann are scheduled to reach the mandatory retirement age prior to our 2018 annual meeting. In view of these scheduled retirements, the Governance Committee has been actively engaged in a process,Board, with the assistance of an executive search firm, to effect a smooth transition of the Board, to fill the gaps in experience these vacancies may create. To that end, since our last annual meeting of shareholders, we have added twofive new independent directors to our Board—Ms. Elane Stock and Mr. Thomas Hough.

joining the Board over the last three years. Since 2013, we have appointed three new independent directors and decreased the average non-management tenure of our independent director nominees from 10.4 years to 8.85.4 years. Individual and average tenure information for our Board (following election of the 11nine independent director nominees named in this Proxy Statement at the 2019 Annual Meeting) is as follows:

TENURE OF NON-MANAGEMENT DIRECTORS

Committee Tenure and Refreshment

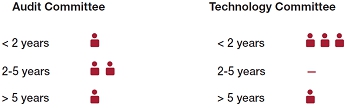

The Governance Committee is responsible for reviewing the composition of committees of the Board. In its review of committee composition, the Governance Committee considers the responses collected during the Board and committee annual self-evaluations, as well as the past experience and relevant skills of each director. Since the 2017 cybersecurity incident, the Governance Committee and the Board have placed a renewed emphasis on refreshing the committees of the Board to ensure each committee has the appropriate relevant mix of skills and experience. Following the 2017 cybersecurity incident, each of the four standing committees of the Board is comprised of at least 50% of directors who were not members of such committee prior to September 2017. In particular, three of the four Technology Committee members joined the Board after September 2017. Individual tenure information for each committee is as follows:

TENURE OF AUDIT AND TECHNOLOGY COMMITTEE MEMBERS

EQUIFAX INC. - 20172019 Proxy Statement 1923

Director Membership Criteria and Nomination Processes

Process for Identifying and Evaluating Director Nominees.Nominees

When the need to fill a new Board seat or vacancy arises, the Governance Committee proceeds in the manner it deems appropriate to identify a qualified candidate or candidates. Candidates may be identified through the engagement of an outside search firm, recommendations from independent directors, the Chairman of the Board, management or other advisors to the Company, and recommendations by shareholders. The Governance Committee Chair and Presiding DirectorChairman of the Board are provided with copies of the resumes for any potential candidates by the search firmso identified and review them as appropriate with the Governance Committee, our CEO and the full Board. Ms. StockOur most recent addition to the Board, Heather Wilson, was identified as a potential candidate by an independent executiveoutside search consultant and Mr. Hough was identified by our CEO and other members of the Board.firm.

Our Governance Committee determines the selection criteria and qualifications for director nominees. As set forth in our Governance Guidelines, thisthese criteria includes,include, among other things, a director candidate’s integrity and ethical standards, independence from management, the ability to provide sound and informed judgment, a history of achievement that reflects superior standards and willingness to commit sufficient time. With respect to the last three additions to the Board, the Governance Committee was also very focused on expertise in data security, risk management, data and analytics and information technology. Since 2018, cybersecurity is one of the skills that the Governance Committee considers in its assessment of Board membership criteria. The Governance Committee and the Board also consider whether the candidate is independent under the standards described under “Director Independence” on page 1922 and whether the candidate is financially literate.

Although the Committee does not have a formal diversity policy for Board membership, it considers whether a director nominee contributes or will contribute to the Board in a way that can enhance the perspective and experience of the Board as a whole through, among other things, diversity in gender, age, ethnicity and professional experience. When current Board members are considered for nomination for re-election, the Committee also takes into consideration their prior Board contributions, performance and meeting attendance records. The effectiveness of the Board’s skills, expertise and background, including its diversity, is also considered as part of the Board’s annual self-assessment.

Directors are limited to service on fivefour other public company boards, not including our Board. Audit Committee members may not serve on the audit committee of more than three public companies absent a Board determination that such service will not impair the ability of such member to serve effectively on the Company’s Audit Committee. In addition, when our CEO is a member of our Board, he or she may not serve on the Board of more than threetwo other public company boards, including our Board.boards.

Procedures for Shareholders to Recommend Director Nominees.Nominees

The Governance Committee will consider for possible nomination qualified Board candidates that are submitted by our shareholders using the same process that applies to candidates identified by other sources. Shareholders wishing to make such a submission may do so by sending the following information to the Governance Committee by November 24, 2017,23, 2019, c/o Equifax Inc., Attn: Office of Corporate Secretary, P.O. Box 4081, Atlanta, Georgia 30302: (1) a nomination notice in accordance with the procedures set forth in Section 1.12 of our Bylaws; (2) a request that the Governance Committee consider the shareholder’s candidate for inclusion in the Board’s slate of nominees for the applicable meeting; and (3) along with the shareholder’s candidate, an undertaking to provide all other information the Committee or the Board may request in connection with their evaluation of the candidate. See “How do I submit a proposal or director nominee for the 2020 Annual Meeting of Shareholders in 2018?Shareholders?” on page 67.79. A copy of our Bylaws is available on our website atwww.equifax.com/about-equifax/corporate-governanceor by writing to the Corporate Secretary.

Any shareholder’s nominee must satisfy the minimum qualifications for any director described above in the judgment of the Governance Committee and the Board. In evaluating shareholder nominees, the Committee and the Board may consider all relevant information, including the factors described above, and additionally may consider the size and duration of the nominating shareholder’s holdings in the Company; whether the nominee is independent of the nominating shareholder and able to represent the interests of the Company and its shareholders as a whole; and the interests and/or intentions of the nominating shareholder.

Director Orientation and Continuing Education